Tata Tech IPO: Shares are available at cheap valuation, should not miss the opportunity! Know 5 reasons

Tata Technologies IPO: After a long wait, Tata Technologies IPO opened for investment today from 22nd November. Its craze is so much that within just an hour this IPO was completely subscribed. It received a total of 6.5 times more bids on the first day. Overall, this IPO of Tata Group, which came after 20 years, was a superhit on its first day. After all, what are those 5 big reasons which make Tata Tech’s IPO attractive for investment, let us know.

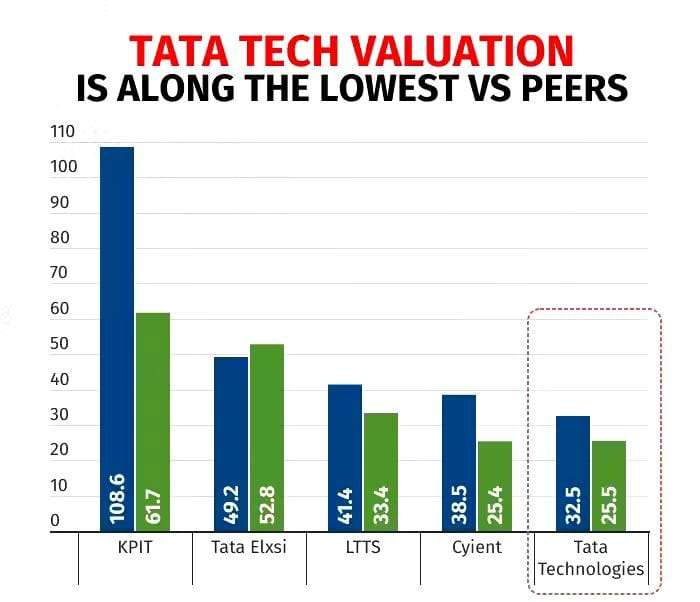

TATA TECH IPO is valued at PE of 32.5 times FY2023 earnings

After a long wait, Tata Technology’s IPO opened for investment today from 22nd November. Its craze was so much that within just 1 hour this IPO was completely subscribed. 6.5 times more bids were received on the first day than yesterday. Overall, this IPO of Tata Group, which came after 20 years, was a superhit on its first day. After all, what are the five big reasons that make Tata Tech IPO attractive for investment? Let us know and also know what is the speciality of Tata Tech and why most of the analysts are advising investment.

What is the real business of Tata Technology?

This company mainly provides train services to automobile companies. Train services means that this company provides all types of services from beginning to end. In this, the concept of tax can be understood by doing research about it. All services are included from manufacturing till its production, even the digital software installed in the tax is also made by this company.

Overall, the company develops products and creates digital solutions related to it. The company has expertise in developing products in the automobile segment, but in the last few years, it has also expanded into other areas related to automobiles. This includes Aero Space Transportation Heavy. Vehicle segment etc. included

Now let us talk about some strong points of Tata Tech which make its IPO attractive.

ERD Market leader in segment

The first reason is that this company is the market leader in PRD i.e. Engineering Research and Development. At the global level, the PRD industry is growing at the rate of 10% annually and its market in India is about 25 billion dollars.

Also, it is expected to grow at the rate of 14 to 17% annually during the next 5 years. Automobile companies spend the most money on the ID industry.

In the coming time, as the trend of electric vehicles, driver less vehicles or connected vehicles increases, the expenses of these companies will increase further. According to an estimate, the expenditure of automobile companies on ARD in the next 10 years will increase It will increase by 3 times because Tata Tech is the market leader company in this segment, hence it is expected to get the maximum benefit from it.

Read this also – Gopal Snacks IPO: FMCG Company will launch IPO of Rs 650 crores, papers filed with SEBI

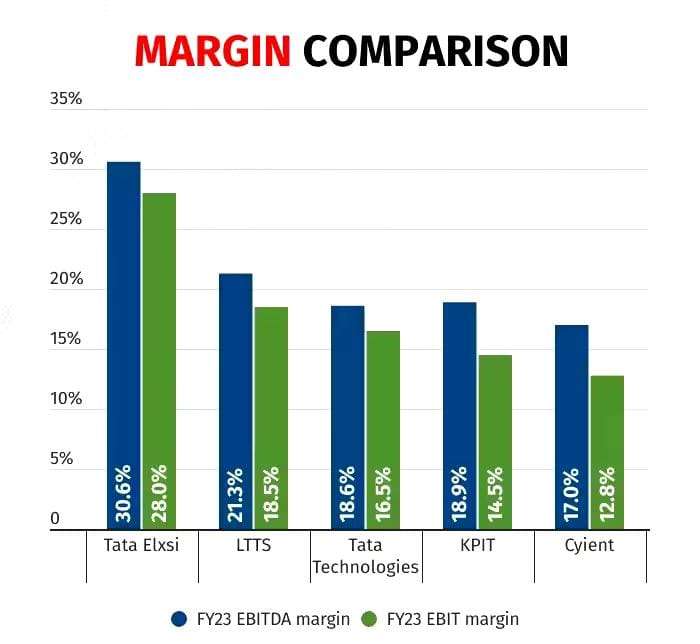

Tata Tech’s margin equal to its rival companies

Another thing that goes in favor of Tata Tech is that its margin is at par with its rival companies. The company’s current EBITDA rate margin is around 18-19 percent if compared to other companies already present in the ERD segment, Like Kapit Tech, their margin is also this much. In this segment, Tata Axi has the highest AB ITDA margin of around 30% while the margin of other companies is between 17 to 20%.

Credit of image: money control

Debt relief company

This is also a good thing. It is also a good thing that Tata Tech’s TV ITDA margin has continuously improved in the last three financial years. Also, the company has no debt, this is its third biggest feature Talking about profit, in the last three financial years its profit has grown at the rate of 61% annually while the revenue has increased at the rate of 36%.

Industry giants in Tata Tiki qualities

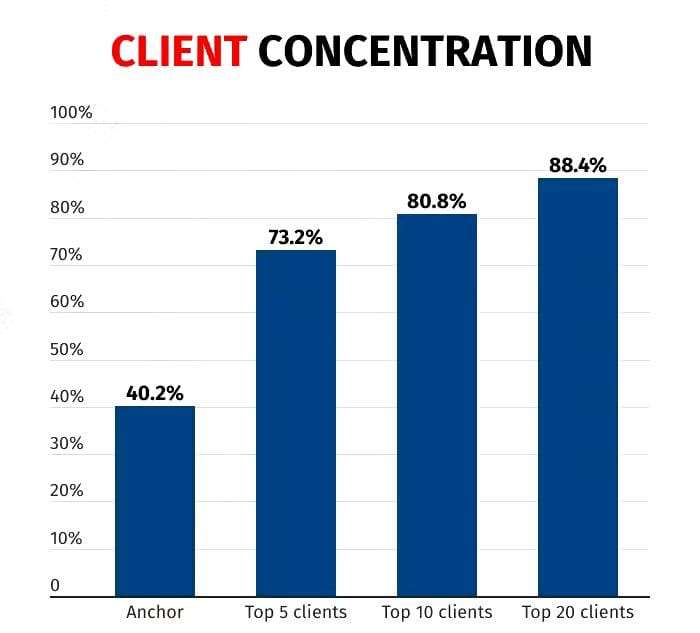

The fourth speciality of Tata Tech is that most of its qualities are the leading companies of the industry. It is among the 10 companies which spend the most on ERD across the world Apart from that, it also has its quality, it includes McLaren One Fast New Tata Motors, Zeller, Honda and Ford etc. Tata Motors is its parent company which is a very present and big brand of its own.

credit of image: Money Control

The company has a lot of expertise

The fifth plus point of Tata Tech is that the company has developed a lot of expertise in its segment and it has provided services to automobile companies and large suppliers giving In the last 10 years, it has completed many successful electric vehicle projects with its expertise and congratulations. This company has a big role in Tata Motors being ahead in the EV segment and this also shows that How quickly does Kia Company adopt new technology.

Tata Tech valuation

The upper price band of the company is ₹ 500 per share. At this price, the valuation of the company comes to 32.5 * P of IK for FY 2023.At the same time, its pay ratio on the estimated income of financial year 2025 is 21.01 times, which is attractive according to the team of Money Control Research.This IPO gives the possibility of book after listing, in such a situation, investors should not miss this IPO. Talking about the main risk, when the companies at the global level do not spend their money on PRD or technology. When the incident starts, its business may come under pressure.

credit of image: Money Control

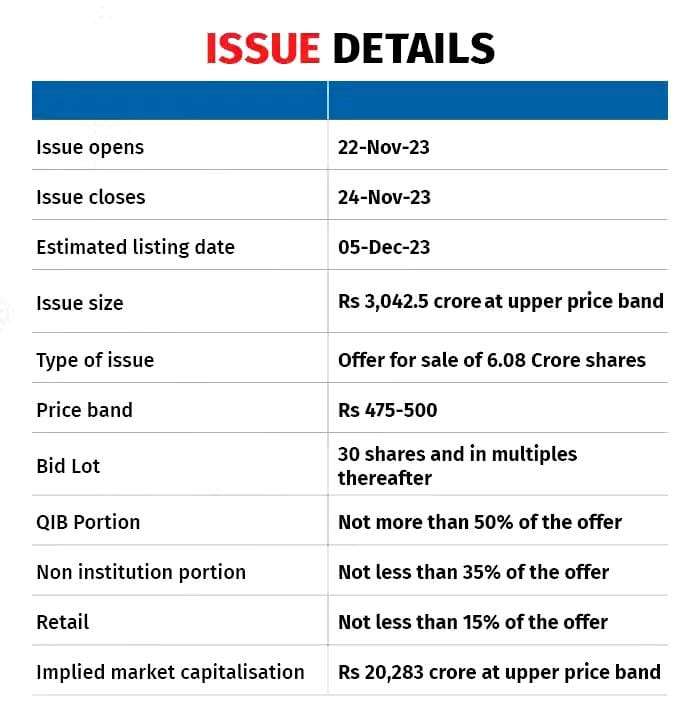

Some basic information related to Tata Tech IPO

credit of image: Money Control

The GDHindustan team has done all this research for you but the credit goes to Money Control too thanks to.